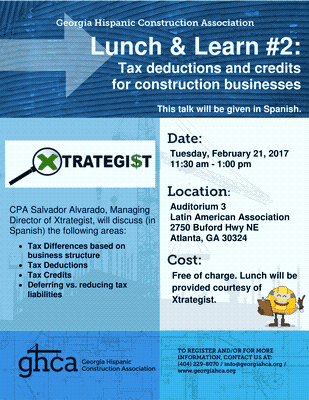

Tax deductions and credits for construction businesses

Date and Time

Tuesday Feb 21, 2017

11:30 AM - 1:00 PM EST

Tuesday, February 21, 2017

11:30 am - 1:00 pm

Location

Latin American Association

2750 Buford Hwy NE

Atlanta, GA 30324

Fees/Admission

Free of charge

Contact Information

Hector Montalvo (404-229-8070)

Send Email

Description

Join us for our 2nd Lunch & Learn of the year! CPA Salvador Alvarado, Managing Director of Xtrategist, will explain (in Spanish) the following areas:

1- Business Structure S-Corp, LLC and Partnership and Tax Differences

2- Tax Deductions

a. Job Costing (Direct and Indirect Costs) and Use of subcontractors.

b. Home Office

c. Operating and Administrative Costs.

d. Hire your children deduction

e. car and truck expenses

f. Reimbursement expenses

g. Customer/client gifts

h. Section 179 deduction (equipment, trucks, machinery, tools and other purchases)

i. Bonus depreciation

j. Trade association dues

h. Continuing education expenses

3- Tax Credits

a. Research & development for construction projects

b. Energy efficiency credit

c. Fuel tax credit

d. Small business health care tax credit

e. Work opportunity tax credit

f. Disabled access tax credit

g. Pension plan start up cost

h. Employer provided child care credit

4 - Deferring vs. reducing tax liabilities

We will provide lunch to all attendees, courtesy of Xtrategist.

Images